Course Description

This course is an introduction to labor economics with an emphasis on applied microeconomic theory and empirical analysis. We are especially interested in the link between research and public policy. Topics to be covered include: labor supply and demand, taxes and transfers, minimum wages, immigration, human capital, …

This course is an introduction to labor economics with an emphasis on applied microeconomic theory and empirical analysis. We are especially interested in the link between research and public policy. Topics to be covered include: labor supply and demand, taxes and transfers, minimum wages, immigration, human capital, education production, inequality, discrimination, unions and strikes, and unemployment.

Course Info

Instructor

Departments

Learning Resource Types

assignment_turned_in

Problem Set Solutions

assignment

Problem Sets

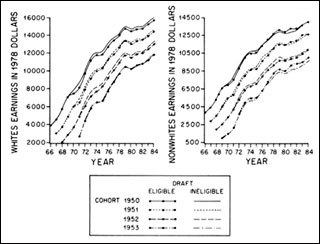

The figure plots the history of FICA taxable earnings for the four cohorts born 1950-1953. For each cohort, separate lines are drawn for draft-eligible and draft-ineligible men. Plotted points show average real (1978) earnings of working men born in 1953, real earnings + $3000 for men born in 1950, real earnings + $2000 for men born in 1951, and real earnings + $1000 for men born in 1952. Figure 1 in “Lifetime Earnings and the Vietnam Era Draft Lottery: Evidence from Social Security Administrative Records” by Joshua Angrist, American Economic Review (December 1990): 1284-1286. (Image courtesy of American Economic Association. Used with permission.)