Course Description

The focus of this course is on financial theory and empirical evidence for making investment decisions. Topics include: portfolio theory; equilibrium models of security prices (including the capital asset pricing model and the arbitrage pricing theory); the empirical behavior of security prices; market efficiency; …

The focus of this course is on financial theory and empirical evidence for making investment decisions. Topics include: portfolio theory; equilibrium models of security prices (including the capital asset pricing model and the arbitrage pricing theory); the empirical behavior of security prices; market efficiency; performance evaluation; and behavioral finance.

Course Info

Instructor

Departments

Learning Resource Types

grading

Exam Solutions

grading

Exams

notes

Lecture Notes

assignment_turned_in

Problem Set Solutions

assignment

Problem Sets

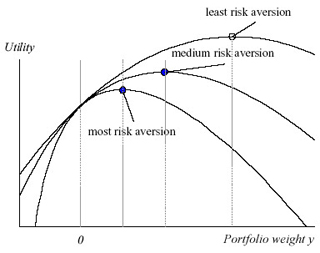

Graph of utility function. (Graph by Prof. Reto Gallati.)