Course Description

This course covers the key quantitative methods of finance: financial econometrics and statistical inference for financial applications; dynamic optimization; Monte Carlo simulation; stochastic (Itô) calculus. These techniques, along with their computer implementation, are covered in depth. Application areas include …

This course covers the key quantitative methods of finance: financial econometrics and statistical inference for financial applications; dynamic optimization; Monte Carlo simulation; stochastic (Itô) calculus. These techniques, along with their computer implementation, are covered in depth. Application areas include portfolio management, risk management, derivatives, and proprietary trading.

Course Info

Instructor

Departments

Learning Resource Types

grading

Exams

notes

Lecture Notes

assignment

Problem Sets

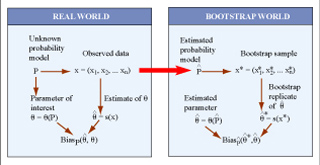

Bootstrap, discussed in Lecture 9, is a re-sampling method which can be used to evaluate properties of statistical estimators. This course covers Bootstrap and other methods used in financial analysis. (Image by MIT OpenCourseWare.)