Course Overview

This page focuses on the course 18.S096 Topics in Mathematics with Applications in Finance as it was taught by Dr. Peter Kempthorne, Dr. Choongbum Lee, Dr. Vasily Strela, and Dr. Jake Xia in Fall 2013.

This introductory mathematics course aims to inspire students to learn and apply mathematical theory and methods that are significant and integral to financial modeling, analysis, and management. The course intermixes lectures on mathematical foundations of modeling in finance with those focused on important real-world problems as presented by professionals in the industry.

Course Outcomes

Course Goals for Students

- Derive price-yield relationship and understand convexity.

- Bootstrap a yield curve.

- Compute standard Value At Risk and understand assumptions behind it.

- Estimate volatility of an option.

- Derive Black-Scholes equations using risk-neutral arguments.

- Understand decomposition of matrices in statistics (and probability) point of view, e.g. principle component analysis.

- Use statistical techniques and methods in data analysis; understand the advantages and limitations of different methods.

- Understand basic limiting theorems and assumptions behind them.

- Understand Ito’s lemma and it’s applications in financial mathematics.

- Understand Girsanov’s theorem and change of measure.

Possibilities for Further Study/Careers

The mathematics lectures in this course introduce and develop important topics of linear algebra, statistical modeling, and stochastic calculus. In addition to demonstrating practical applications of theory, an objective of the lecture presentations is to inspire students to pursue further study in these areas.

Instructor Interview

"A framework that explicitly connects theory and practice is a valid platform for many disciplines. We encourage educators to try it."

Below Peter Kempthorne, Vasily Strela, and Jake Xia describe aspects of developing and teaching 18.S096 Topics in Mathematics with Applications in Finance.

Course Development

Two members of our teaching team—Jake and Vasily—both alumni of MIT and industry professionals—were interested in creating a meaningful collaboration with MIT as a way to give back to the institution. They determined, after meeting with faculty, that developing a course designed to help students understand how their skills could be applied in the financial industry would be of mutual interest to the instructors, faculty, and students. Jake and Vasily viewed it as an exciting opportunity to show students what they could do in the real world after they graduated.

The first time the class was taught (Fall 2012), it consisted only of invited lectures from Morgan Stanley professionals. However, after teaching the course this way for one semester, we decided it would benefit students if we incorporated a pure math component in order to better integrate theory and practice. The math lectures are fun to teach because applications in finance rely so much on mathematical theory. Because specific applications in finance extend to other disciplines, as well, 18.S096 has developed into a rigorous applied mathematics course.

Highlighting Connections Between Theory and Practice

The considerable breadth of topics covered in our course highlights the wide range of real-world problems where applications of mathematical analyses are especially effective. The mathematics lectures are designed to focus on foundations of the mathematical theory underlying these analyses and provide a solid framework supporting the course. As noted above, members of our course staff have combined experience in industry and academics and together they highlight connections between theory and practice in both the mathematics and applied lectures throughout the course.

The emphasis of specific topics alternates between mathematics and applications but the lectures typically integrate the two. The mathematics lectures detailing formal abstractions of the theory are motivated and illustrated with applications. The applications lectures introducing analytic problems faced by industry professionals include theoretical sections highlighting the mathematical analysis contributing to best-practice solutions of the industry.

To provide students with a hands-on introduction and experience in financial modeling, the course includes case studies addressing a variety of topics including asset pricing models, volatility modeling, and factor modeling. Using R, a free software environment for statistical computing and graphics, analytic methods introduced and developed in the theoretical lecture sections are illustrated using publicly available financial data collected from the Internet. Using the R script programs provided with the case study materials, students have the opportunity reproduce the analyses on their own computers and pursue extended studies/analyses of their own.

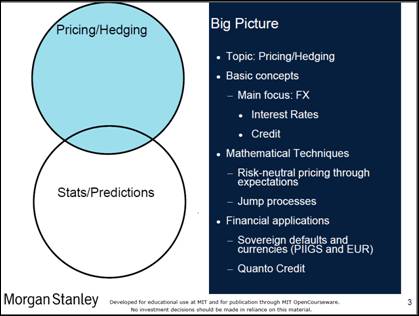

Slide 3 from Dr. Stephan Andreev’s lecture on Quanto Credit Hedging. Photo courtesy of Dr. Stefan Andreev.

The course also includes an optional fieldtrip to the Morgan Stanley headquarters in New York. Industry professionals meet with students and inspire them to consider employment in the financial sector. Students tour the trading desk and talk directly with professionals who are actively solving mathematical problems. A framework that explicitly connects theory and practice is a valid platform for many disciplines. We encourage educators to try it.

Meeting the Needs of Diverse Learners

Participants in this class range from undergraduates to advanced level graduate students. They come from a variety of academic fields. Some have had internships in the financial sector, while others come with only a limited understanding of how stock markets operate. Our objective is to make the course accessible to students meeting the minimum requirements while also stimulating to all students regardless of their experience with finance and knowledge of quantitative methods. The course project, a term paper on a topic chosen by each student, allows students to demonstrate their learning and understanding of advanced material specific to their experience and mathematical background.

One challenge we face is designing problem sets suitable for the mixed mathematical backgrounds of students. Future offerings will distinguish core versus advanced problems to challenge students appropriately. Also, we are considering adding quizzes relating to financial terms and the applications lectures. The intention is to improve the assessment of student performance and participation in all aspects of the course. In fact, students’ active participation during lectures helps us tailor content to meet diverse learners’ needs. We want them to ask questions. With this in mind, we have recently included students’ participation as part of their grade for the course.

Advice for Educators Establishing Partnerships

While 18.S096 grew from Vasily’s and Jake’s interest in collaborating with MIT (i.e. industry professionals reached out to faculty), there may be educators in academia who hope to initiate partnerships with industry professionals. We recommend that these educators first focus their curricular goals. There are so many domains within finance. If a class is too loosely constructed, the partnership will be less successful. We then recommend reaching out to alumni. It’s important to identify individuals in industry who are willing to commit the substantial amount of time needed to prepare quality lectures. We suggest videotaping partners as they deliver their lectures. We’ve learned so much about how to improve our own teaching by watching ourselves on the videos captured for MIT’s OpenCourseWare. It allows us to see ourselves as the students see us and to make changes in response to this unique perspective. We hope educators will make use of the video lectures on OCW, along with our other course materials, in order to provide a virtual industry partnership when it is not practical to establish an actual partnership.

Curriculum Information

Prerequisites

- 18.01 Single Variable Calculus

- 18.02 Multivariable Calculus

- 18.03 Differential Equations

- 18.05 Introduction to Probability and Statistics or 18.440 Probability and Random Variables

- 18.06 Linear Algebra

Requirements Satisfied

None

Offered

Every fall semester

Student Information

Enrollment

50 students

Breakdown by Year

Mostly undergraduates and a few graduate students.

Breakdown by Major

Most students were Mathematics majors. There were also some students from Electrical Engineering and Computer Science, Economics, and Aeronautics and Astronautics. About half the students had no prior experience with finance.

Typical Student Background

About half the students had no prior experience with finance. The course is designed to appeal to students with a range of backgrounds.

Ideal Class Size

It is ideal to have 25-50 students.

How Student Time Was Spent

During an average week, students were expected to spend 12 hours on the course, roughly divided as follows:

Lecture

- Mathematics lectures detailing formal abstractions of theory

- Application lectures introducing analytic problems faced by industry professionals

Out of Class

- Problem sets due two weeks after each lecture

- Final paper on a math finance topic of student’s choice